SUSTAINABILITY REVIEW

Swedish Stirling

Working to scale up their Stirling technology that enable some of the world’s largest emitters to reduce carbon footprint, flaring, and produce electricity from waste gas, clearly puts Swedish Stirling in the green from a sustainability point of view. However, going from an R&D organisation, with few sustainability risks, to an industrial producer with counterparties in emerging markets widens the spectrum of sustainability issues to address, from LCA-analysis of produced units to anti-corruption, employee and subcontractor responsibilities. Looking at ESG-factors through a SWOT-filter shows high scores on the environmental side with some lurking challenges on the social and governance side as the roll-out commences.

Johan Widmark | 2022-05-09 12:00

SUSTAINABILITY AS A GAUGE OF BUSINESS LONGEVITY This commissioned sustainability research does not intend to review the quality or standards of the company’s sustainability reporting. Sustainers does not calculate a quantitative ESG score, and this report is not a complete ESG scorecard. Sustainers focusses on analysing the ESG dynamics at play in the individual company to use sustainability as a gauge of business longevity, for the benefit of long-term investors.

High positive impact at first level

Swedish Stirling’s technology gives its customers climate positive electricity at competitive rates. The product – the PWR BLOK – enables significantly reduced carbon dioxide emissions for customers that otherwise use electricity produced from foosil fuels. By its unique proprietary solution for recovering energy from industrial residual and flare gasses and converting these into 100% carbon neutral electricity at high efficiency, Swedish Stirling is contributing to the UN’s goals for global sustainable development.

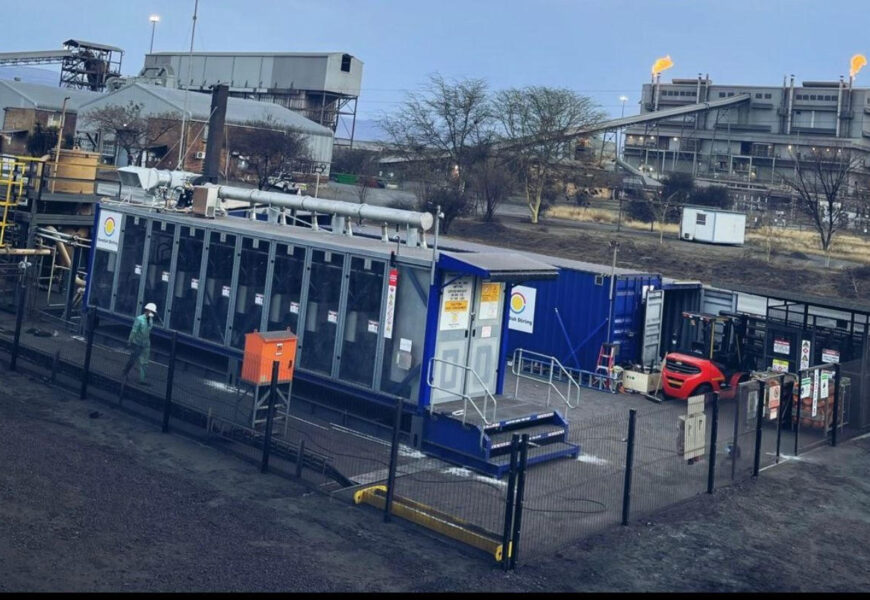

As a first step in the Swedish Stirling long-term roll-out plan, the company has chosen to focus on the South African ferrochrome industry, where company calculates that one PWR BLOK producing 400 kW generates 3,500 tonnes in annual CO2 emissions reduction. The PWR BLOK has an efficiency of approximately 29%, which means that the energy recovered from the residual gas reduces the customer’s need for purchased grid electricity by approx. 15%.

Recovering all the energy from the South African ferrochrome industry’s residual gasses using the PWR BLOK would reduce carbon dioxide emissions in South Africa by nearly 2,000,000 tonnes annually. That is three times as much as the emissions caused by the Swedish domestic aviation.

KEY STRENGTH

• High capacity for positive impact

KEY WEAKNESS

• Yet to publish sustainability report

KEY OPPORTUNITY

• Expansion to Europe with inclusion in emissions trading scheme

KEY THREAT

• Remote counterparties in region with elevated risk of corruption

Room to improve on a very strong environmental profile

STRENGTH and OPPORTUNITY: High capacity for meaningful positive impact on carbon emissions. According to Lloyd’s Register, an independent certification company – Swedish Stirling’s PWR BLOK is the cheapest way to generate electricity that exists today, yielding greater CO2 savings per SEK invested than any other type of energy.

WEAKNESS and OPPORTUNITY: Swedish Stirling has yet to publish an LCA-analysis for the Stirling engine. According to the management, this is underway and will hopefully detail the full carbon impact including the 10 000 km boat ride to South Africa as well as decommissioning.

OPPORTUNITY: While a future expansion in Europe with partner SMS Group will shorten transport, it will also change the positive environmental impact because of the differences in the customers’ energy mix. In South Africa, coal accounts for 69% of the national energy mix, while in Spain for example, oil accounts for 42% of the national energy mix and gas for 20% (gas also emitts half as much CO2 compared to coal). In Europe, the trading scheme for CO2 emission rights also gives the owner of the PWR BLOK right to capitalize on the emissions reductions. Adjusted for changes in national energy mix, one PWR BLOK in Spain would generate approx. 2,200 tonnes in CO2-savings. At current 87 EUR per tonne, this means an annual income for the owner of 190 000 EUR for each PWR BLOK.

Challenges within social mainly associated with geographics

THREAT: Conducting business in emerging markets tends to elevate risks associated with corruption. South Africa ranks 70th place on Transparency International’s Corruption Perceptions Index, next to Jamaica (70) and Tunisia (70), and next to China (66) and Hungary (73). The company’s association with metal giant Glencore and its peer Samancor in its dealings in South Africa can however be expected to provide some insulation from corruptive pressure.

STRENGTH: According to the Company, Swedish Strling only does business with customers who actually benefit from the deal and that they will not agree to pay excessive remunerations or benefits to anyone to close a deal, nor will it agree to accept such remuneration. Swedish Stirling always endeavors to ensure that each transaction will be sustainable, that is, economically sound in the long term and competitive in its own right, instead of being dependent on public grants or subsidies.

Governance a strong discipline for most Swedish companies

THREAT: Conducting business literally half a world away from headquarters and production in Sweden places special demand on processes and corporate management.

STRENGTH: As a listed public company, Swedish Stirling follows Nasdaq First North’s Rule Book for Issuers and the Swedish Code of Corporate Governance. This puts Swedish Stirling, as most swedish public companies, ahead of many international peers in terms of governance. With regards to diversity three of five members of the board are female, and do not see any risk areas for conflicts of interests at present.

STRENGTH: In the Annual report, we can read that Swedish Stirling takes environmental responsibility both by working according to procedures and regulations to reduce the impact of its own operations, as well as by collaborating with suppliers subject to stringent environmental and quality requirements, such as ISO 14001, ISO 9001 certification and the automotive industry’s IATF 16494 quality standard.

Current state of sustainability reporting

As Swedish Stirling is now starting series production of the PWR BLOK, the Company has communicated its intent to review operations from a sustainability perspective with the ambition to develop and update policies, routines, regulations, and relevant key figures for the Company’s overall sustainability work. As of now however, the company has not published a dedicated sustanability report, but plan to do so. This report will aim to present the information necessary to understand the consequences of the business in terms of environment (use of energy, water, greenhouse gas emissions and other pollutants), social and personnel related issues (gender equality, working conditions, health and safety), respect for human rights and anti-corruption. The Company will also report on the sustainability risks present within the business, such as business relationships, products, and services, and how to manage these risks.

Conclusion

Seeing sustainability as a gauge of business longevity, Swedish Stirling comes out on top, although there are some challenges emerging in the wake of the company’s international roll-out. With the expected transfer to the main market in Stockholm and the publication of a dedicated sustainability report, Swedish Stirling is likely to increase transparency and disclosure on its sustainability efforts, thereby lowering risk and strengthen business longevity in a hopefully positive feedback loop.

DISCLAIMER