Andreas Eriksson | 2022-08-23 08:00

Half year report with mixed impressions

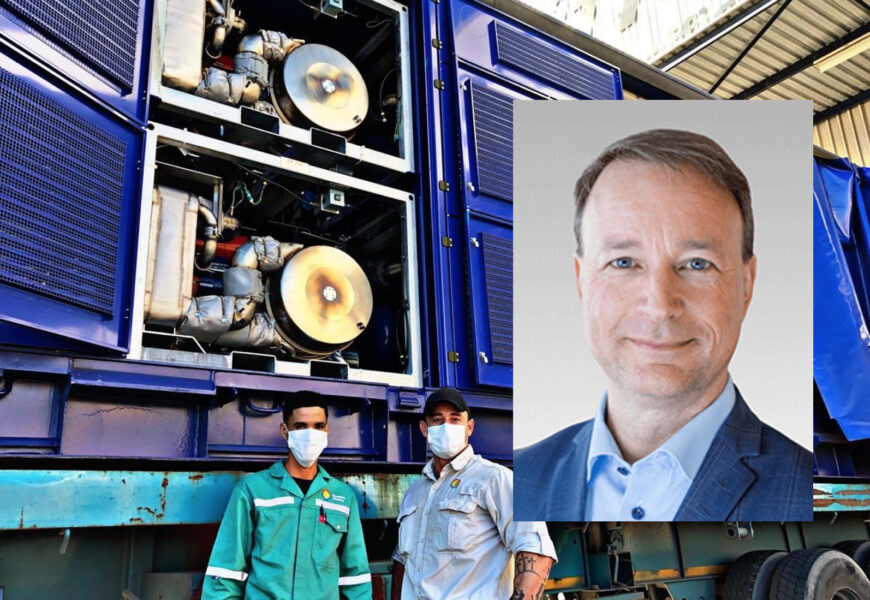

Swedish Stirling’s report for Q2’22 showed that the shipment of the first six units PWR BLOK to Glencore’s Lion Smelter is proceeding according to plan. Strengthened by a Glencore management visit to the finished production line in Sibbhult as well as the main office in Gothenburg, the two companies’ relationship seem on track.

However, the negotiations with the second South African chrome giant, Samancor, and the delivery of 18 MW worth of PWR BLOKs to TC Smelter have been stalled due to that needed terms cannot be agreed upon at this stage. This raises a big question regarding the remaining 36 MW that was included in the original LOI signed in 2020. The flipside however, is that it shows that Swedish Stirling isn’t jumping on every deal they can get their hands on – profitable growth is key, and according to management there’s no shortage of interest from other potential customers.

Renowned names leading green preference share issue

The first 10MW installation at Glencore’s Lion Smelter will genereate up to 87,500 tonnes of annual CO2 emission savings. Running the PWR BLOK will also entitle the owner of the technology to emission allowances equeal to the amount of CO2 emissions saved, which in these initial installations at Glencore will be Swedish Stirling. As the market for emission allowances in South Africa isn’t on par with Europe, the company has explored the possibility to tie the CO2-reduction to a preference share issue.

Renowned names like Glencore, Merafe and the af Jochnick family have now been tied as anchor investors, and it’s now up to the board to make the final decision, which we expect in the near future. Having Glencore, one of the biggest mining companies in the world, as a cornerstone in this round, we believe sends a strong message to following investors.

Short term dip while long term upside remains

On our site visit in South Africa we got a first hand look at both Glencore’s Lion Smelter and Samancor’s TC Smelter. This strenghened our conviction that the need for technology like Swedish Stirling’s, will only increase in the future. Discussions with Samancor will continue, as well as with Glencore about deliveries to other sites, and discussions with Richards Bay Alloys has been resumed after their renovation plans got put on hold during the pandemic.

The LOI with Samancor accounts for about half of the total pipeline in South Africa (3 sites x 18MW), and since negociations for TC Smelter at least for the moment have been stalled we’ve added a 20% uncertainty discount on our forecast where our combined DCF and multiple approach now supports a fair value of SEK 15-22 (18-26) per share in 18-24 months. We do however note some potential triggers for the second half of 2022 and for 2023, with a green preference share issue, potential new firm deals after the installation at Lion progresses, and real proof of work once Lion is up and running.

DISCLAIMER