Simris’ expanded objective to leverage the acquisition of Cyano Biotech in Q3’22, enter the high-value biopharma space and build a science-based vertically integrated company represents a business transformation that shows many similarities to what AAK (AAK SS, Mkt Cap 46.5 BN SEK) did in industrial fats. This is underscored by the proposed name change to Simris Group. Now the immediate focus is on cyanobacteria and the ADC space, where we see a real opportunity for large revenues in the near-term, as evidenced by the more than doubling of the share price year to date.

We continue to find support for a fair value of 170-230 MSEK, which translates to 0.94 – 1.28 SEK per share in 12-24 months and note that the additional 0.5 MEUR flexible funding facility with The Brand Laboratories has alleviated the need for external financing in the short term.

Johan Widmark | 2023-02-20 08:00

ADC a real opportunity for large revenues

Reading the Q4’22 report it is clear that the Company is highly focused on driving revenue from Cyano Biotech, adding further value to the science and sign its first licensing agreements. Interestingly, Simis’ Chairman highlights that there is a very real opportunity to generate large revenues in the near term, especially in the ADC space. With that in mind we look forward to one of the leading conferences for the global ADC industry in London in March, which Simris’ management will attend.

Algae as the source

In early January 2023, Simris launched its newly reformulated Omega-3 product containing both EPA and DHA, which can now be sold in the EU. This newly formulated product is EFSA-approved, highly concentrated and with a capsule that is half the size, and yet contains twice as much EPA and DHA as before. Using refill pouches, Simris also targets a substantially lower price point to encourage more consumers to make the switch to algal Omega-3. After the launch in Sweden, the plan is to launch in the USA in February and expand to other key markets in Europe later in 2023.

Drivers for revenue growth in 2023 and beyond

As the photobioreactors (PBRs) were shut down and upgraded during winter thereby putting the development work around Simris’ Fucoxanthin product for B2B sale was on pause, sales in Q4 were down some 89% in Q4’22. However, in addition to Omega-3, Simris now has the structural foundation in place to exploit the most promising verticals in the microalgae and cyanobacteria space. With an historic revenue around 0.5 MEUR for Cyano Biotech, the relaunch of food supplements and a refinement and expansion of the B2B offering later in 2023, we find support for a sharp rise in revenues later in the year.

As we’ve pointed out earlier, the relaunch of food supplements is likely to increase costs during launch phase, while the optimized production of Fucoxanthin and new B2B business will impact revenues starting H2’23. However, the announcement of an increase by 0,5 MEUR of the flexible funding facility from The Brand Laboratories, a company associated with Simris’ Chairman, Steven Schapera, to a total of 1.5 MEUR means that the short-term funding should be covered.

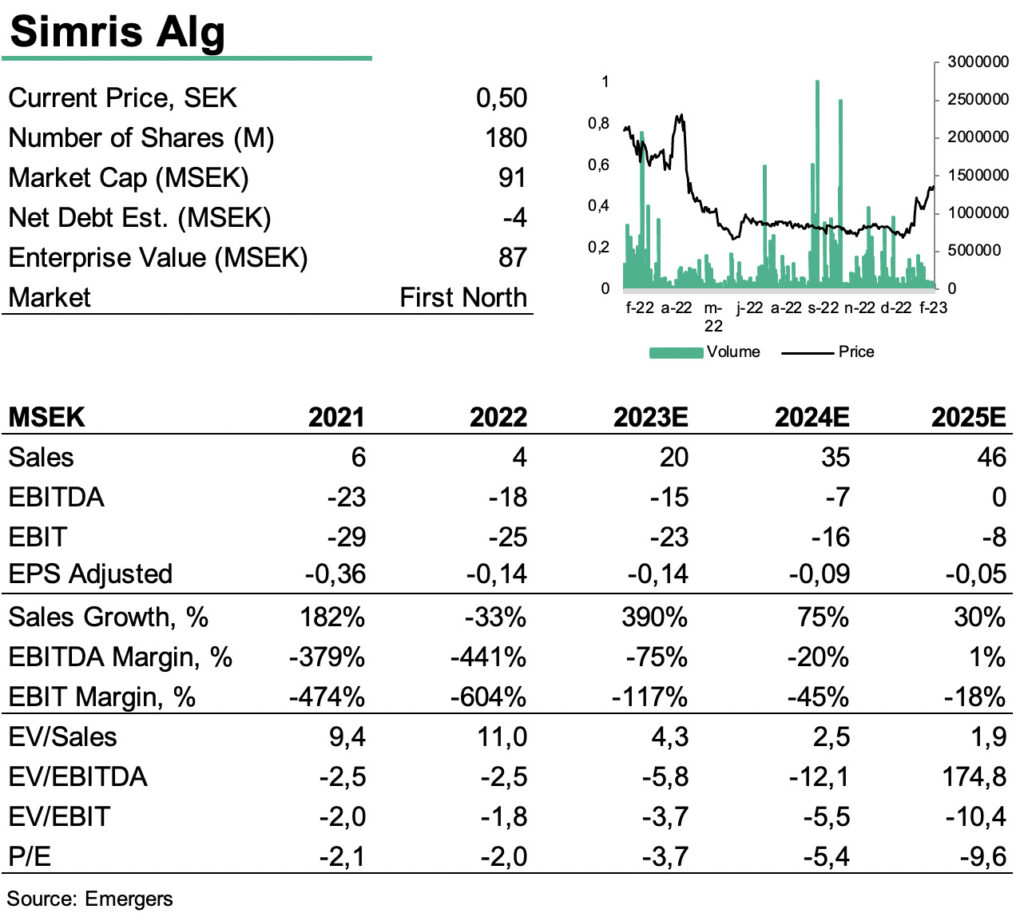

Significant revaluation potential

In our model we forecast Simris to reach positive EBITDA no sooner than 2025. But in somewhere between a base case and a best case-scenario, the positive momentum in the share, along with a successful launch of Omega-3 and the B2B sales should give the company runway to reach a stronger position before financing becomes an issue. With a clear plan and roadmap for each vertical, focusing on the most high-value opportunities in each field, management is now executing on a strategy that is likely to produce most value for shareholders in the long-term.

All in all, we continue to see a significant revaluation potential in Simris. With only a fraction of listed peer multiples, we continue to find support for a fair value of SEK 170-230m in 12-24 months. This translates to 0.94 SEK and 1.28 SEK per share in 2023-2024, before adjustment for any potential rights issue. However, should Simris produce an ADC platform license deal this will boost potential even further.

DISCLAIMER