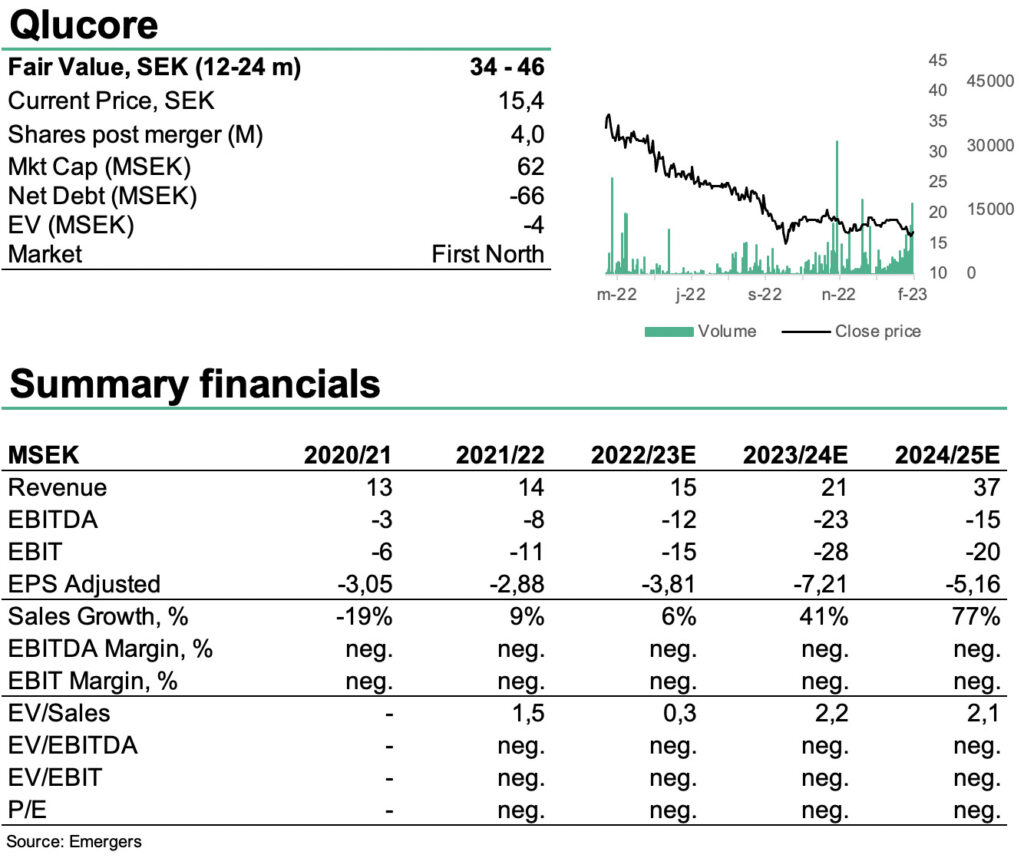

The progress in Q3’22/23 (Nov–Jan) continues to support the long term case we’re seeing in Qlucore, where the company aims to provide laboratories with its Diagnostics software to analyze complex data sets to enable a more individualized treatment, primarily for cancers. With Net Cash still above the current market cap we see limited downside in the valuation and maintain our fair value of 34-46 SEK in 12-24 months. After the first demonstration of a preliminary classification model for bladder cancer carried out during Q3, the next important step is now the announcement of a target date for the CE marking.

Johan Widmark | 2023-03-02 08:00

A soft quarter in line with plan and our forecast

While revenues in Q3’22/23 (Nov-Jan) were down 22% (after strong comparable with 50% growth same period previous year) to SEK 4.3m, in line with our forecast, Qlucore is on track to reach our forecast for the full year 2022/2023 of SEK 15m. As expected, revenues in the quarter consist almost entirely of the data analysis segment with Qlucore Omics Explorer. EBIT at SEK -2.9m was slightly stronger the SEK -5m loss we expected. Net cash now amounts to SEK 66m, marginally above the company’s market cap. After the Q3-report we’ve only made some minor upwards revisions to our EBIT forecast for the full year, and keep our long term forecast for 2023/24 and beyond unchanged.

Contract with Notified Body important milestone

In addition to Qlucore Omics Explorer, Qlucore provides two software packages for clinical RNA-seq data analyses to facilitate classification of cancer patients as well as detailed gene fusion analysis. Those are Qlucore Insights that is already available and used at several customer sites, but for research use only, and Qlucore Diagnostics which is under development and targeted for CE-IVDR compliance. The main news item in the Q3-report was that Qlucore now has a contract signed with a Notified Body for the certification of Qlucore Diagnostics according to IVDR (CE marking), which will be required for launch. Considering that access to Notified Bodies is constrained, this both confirms the maturity of the product and signifies an important milestone of the development schedule. Now the next important step we await is the announcement of a target date for the CE marking.

Share still trading below cash with considerable upside

Qlucore continues to invest heavily in the development of cancer diagnostics tool Qlucore Insights/Diagnostics. After the Q3’22 report, we maintain our base case of a CE approval for the Qlucore Diagnostics platform and ALL in 2024, with a subsequent increase in the number of labs to 70-100 labs by 2027/28. With an estimate of the number of tests per lab at 2,500-4,000 per year, and an estimated price per test of SEK 1,000, we find support for the company’s sales target of SEK 300m in 2027/28 and a 40% EBIT margin. Based on a combined DCF and multiple valuation we continue to find support for a fair value of SEK 34-46 in 12-24 months, leaving plenty of upside from today’s level. We now see a) progress on CE application and CE marking target date announcement, b) new license sales, and c) the first Diagnostics sales as the most important catalysts for the share.

DISCLAIMER