Johan Widmark | 2025-01-20 08:00

bioMérieux paying EUR 138m for SpinChip

Global leader in in-vitro diagnostics, bioMérieux has announced the acquisition of Norwegian point-of-care (POC) platform for rapid in vitro diagnostics, SpinChip, for a total enterprise value of EUR 138m or around SEK 1.6 bn. Similar to Prolight, SpinChip’s platform will offer rapid (<10 minute), lab-quality diagnostic results primarily used for cardiac markers. SpinChip’s solution has been validated in a retrospective clinical study and is currently being assessed in a multicenter European clinical trial with the aim to submit an application for CE marking under the IVDR before the end of 2025.

The SpinChip deal clearly illustrates the significant interest in POC testing among global industrial players, and that POC is now a key component of these companies’ strategic plans. However, with revenues in 2023 of EUR 3.7 billion, direct operations in 45 countries and services through a comprehensive network of distributors in over 160 countries, bioMérieux is a prominent player in the global diagnostics industry, with a significant market presence and extensive distribution capabilities. The Spinchip POC system is a bench top instrument, i.e. it is not portable. The Prolight POC system Psyros is portable and may also be brought in ambulances to allow rapid near patient testing on site. In addition the Psyros cartridge is already designed for multiplex and is said to have a very low cost of manufacturing (COGS).

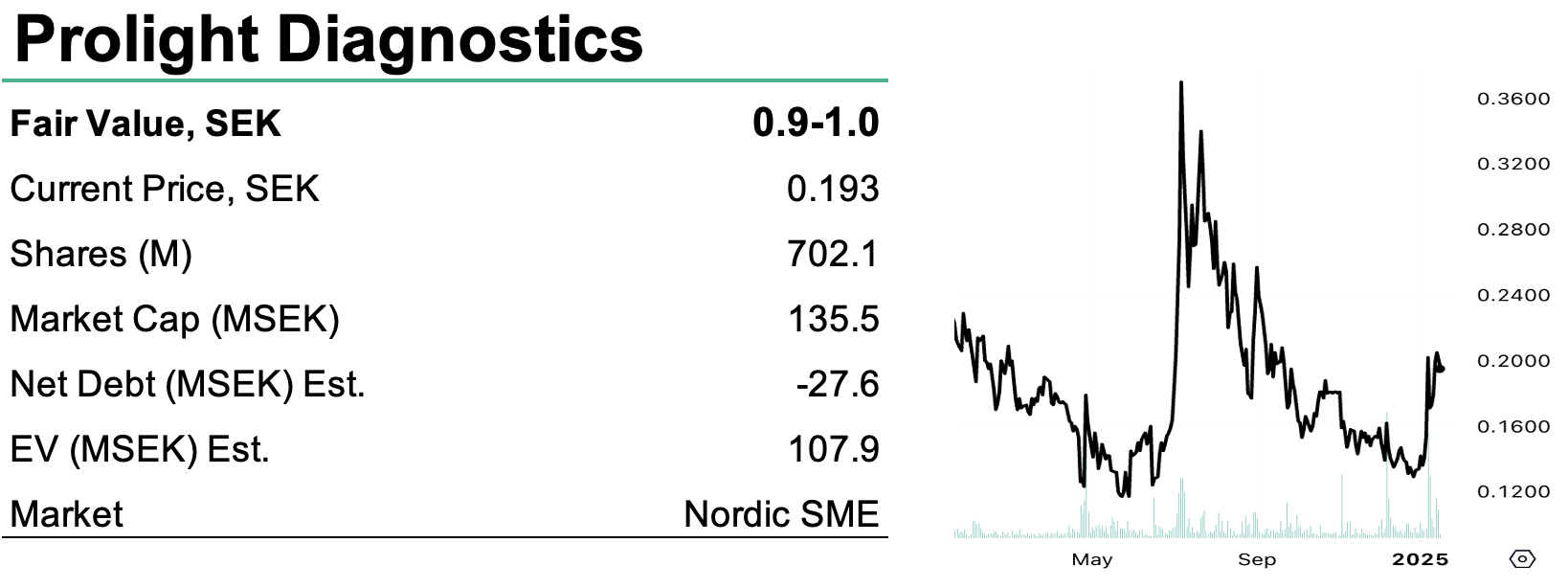

The SpinChip deal value is not a straight readacross to our fair value for Prolight, where we find support for a fair value of around SEK 650m. The main difference being that the SpinChip deal is a full takeover, whereas our fair value for Prolight is based on a license deal with a bigger player in diagnostics. This assumes that this licensee has the financial capacity to take the upfront investment in marketing, and that it also has the sales and distribution network to limit COGS and SG&A to a combined 45% of sales. Applying the takeover scenario to our numbers, which means that the model is not burdened by any royalty and milestones, but also involes a markely higher risk for the licensee/acquirer, this supports a value of USD 150m or SEK 1600 bn, translating to SEK 2.1 per share.