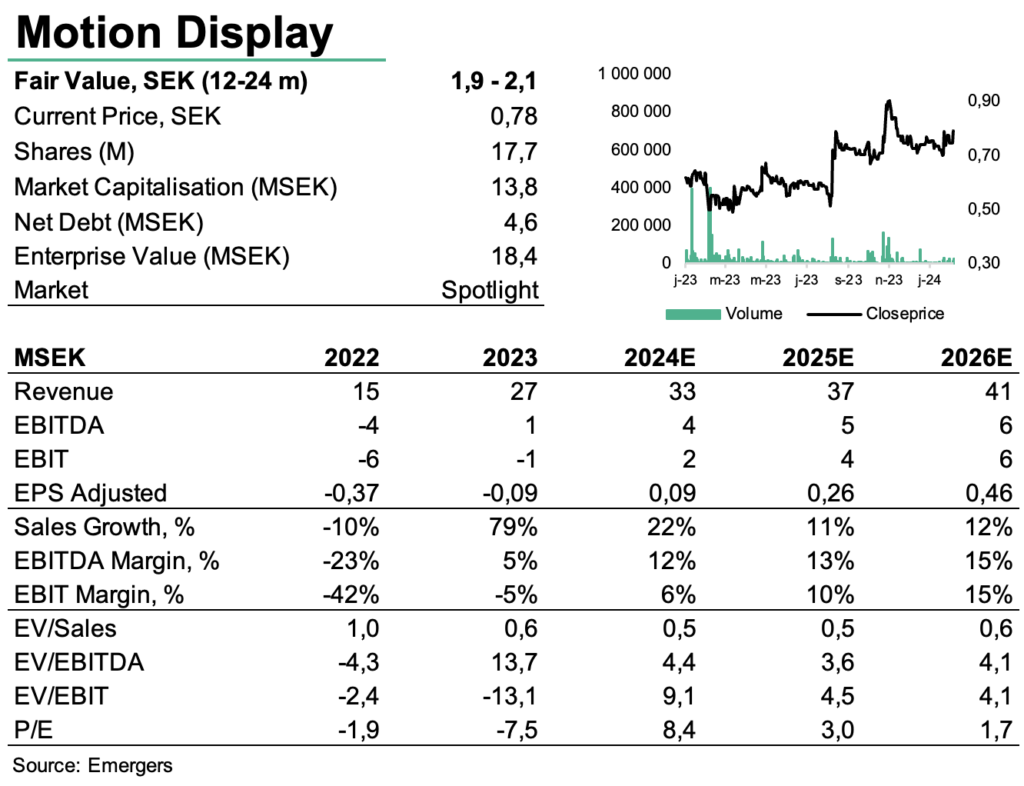

Motion Display ended the year with the same strong momentum as seen earlier in 2024, with 65% growth in Q4’23 and 79% for the full year. This resulted in a positive EBITDA for the full year (SEK 1.3m), albeit a slight loss in Q4 (SEK -0,4m). Thanks to strong performance, the EU and the rest of the world (SEK 14.3m) have now surpassed the USA (SEK 12.7m) in terms of revenue. The order backlog is strong at SEK 9.2m – a sequential doubling since Q3’23. However, even more important are the deepened collaborations with global procurement organizations, which serve as important gateway actors to the company’s customers, where the share now accounts for 30% of revenue, suggesting continued strong momentum into 2024. With a weak cash position at SEK 0.08m and a continued liquidity squeeze from suppliers and customers, we expect some form of action to strengthen liquidity. Overall, we continue to see support for a fair value of SEK 1.9-2.1 per share, although a potential issuance could dilute that somewhat.

Johan Widmark | 2023-02-23 08:00

Diversifying in Europe

Historically reliant solely on the American retail market, especially on the retail giant Walmart, Motion Display has actively worked to diversify its exposure over the last 36 months. While the American market still contributes occasional orders, the company has achieved a consistent order intake from the European market after gaining ’approved supplier’ status from one of the largest purchasing organizations. We expect that continued deepened relations with these procurement organizations will accelerate growth further.

Healthy acceleration in momentum

The pandemic hit the sector of physical stores hard, but we now see several signs of a return to (a new kind of) normal, also for retail. Order intake in Q4’23 amounted to SEK 10m, which is a clear acceleration from SEK 5.9m in Q3’23, and the SEK 9.2m order backlog at the end of Q4’23 represents more than a doubling from SEK 4.5m at the end of Q3’23. This is a strong signal that the healthy positive momentum will last into 2024.

Diversified exposure lowers longer term risk

MODI closed Q4’23 with a cash position of SEK 0.1m, which is concerningly low. However, considering the company has achieved positive EBITDA for the full year, although a slight loss in Q4, it appears that some form of bridge financing could be a likely option, although it is too early to rule out a rights issue. Our forecast is based on sales of SEK 33m for 2024 and a 10% annual growth thereafter. With a long-term gross margin of 50% and a discount rate (WACC) of 23%, our combined DCF and target multiple valuation (1x sales’24 support a fair value range of SEK 1.9-2.1 per share in 12-24 months.

DISCLAIMER