Johan Widmark | 2023-11-01 08:00

29% sales growth in Q3

Sales increased 29% to SEK 9.9m in Q3’23. While the deliveries of IMUs to Saab did in fact start in Q3, driving the growth in the quarter, the pace of the ramp-up was slower than we had estimated.

Interestingly, as the Saab IMUs accounted for the bulk of growth in the quarter, we noted that adjusted gross margin at 35% was lower than we had expected. Personnel expenses and other OPEX on the other hand, were lower than expected, leading to an EBIT-loss of SEK 10.5m in Q3. While we do expect gross margin to improve, driven by scale and mix effects in 2024 and beyond, we have lowered our gross margin estimate for 2024 and 2025 by 5ppt, while also trimming our OPEX forecast.

Revising forecast, continue to expect steep growth in 2024

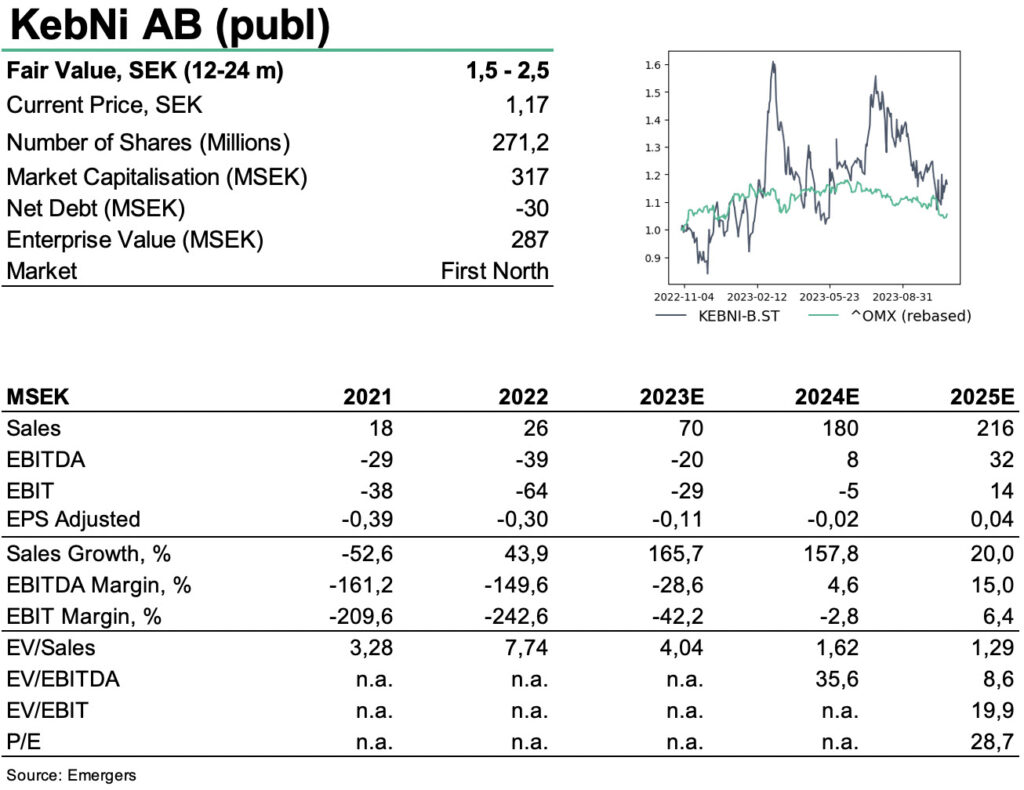

The lower-than-expected sales and gross margin, and better than expected OPEX in Q3 have led us to revise our forecast for FY’2023 to SEK 70m (85), as we still expect a significant rise in sales in Q4. We also expect the company to reach positive CF on a quarterly basis by the end of 2024, but a positive result and cash flow on an annual basis not until 2025. Current SEK 30m in cash should be sufficient for the company to reach positive cash flow.

We now look forward to confirmation of the volumes series ramp-up in the reported numbers in Q4, more activities within SatCom and with SensAItion, and progress with the JV ScaffSense. In our combined DCF and earnings multiple approach we now find support for a fair value of SEK 1.5-2.5 (1.7-2.7) per share, with Saab volume orders feeding through to a significant increase in sales, enhanced earnings, and positive cash flow from 2024 to 2026, as the primary catalyst.

DISCLAIMER