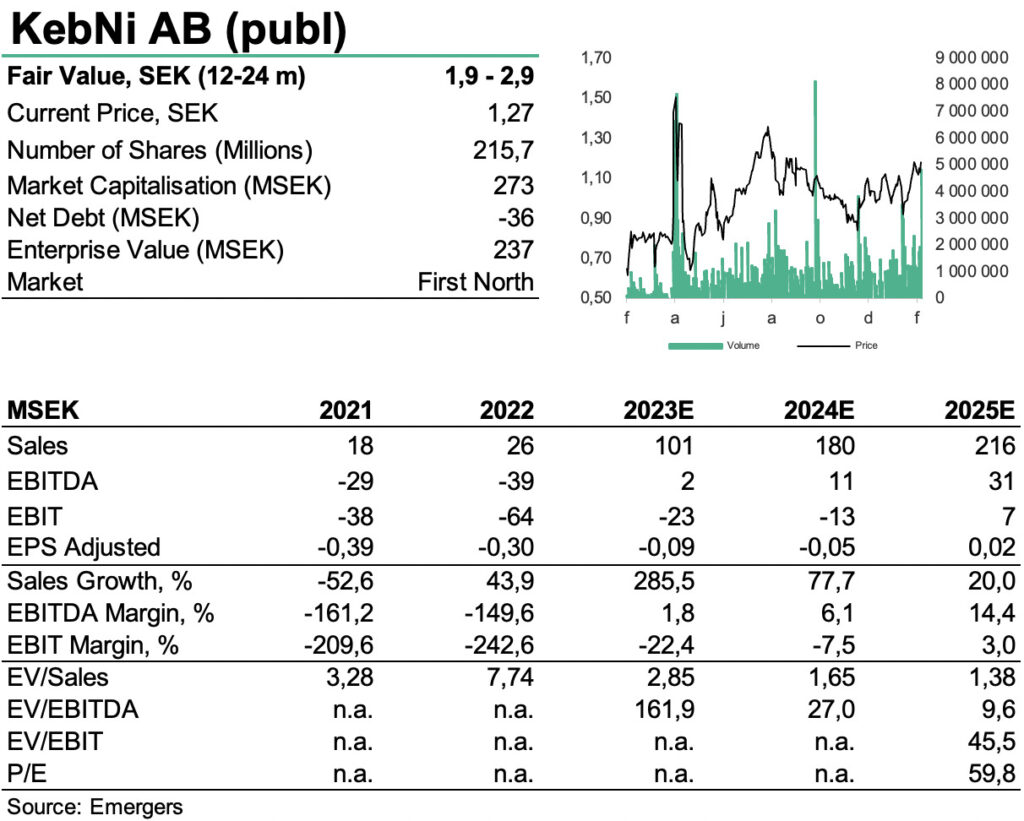

With another NLAW order, from Finland of SEK 400m, Saab’s delivery timeline support a revenue scenario for KebNi that exceeds its own revenue targets for 2024. Simultaneously, we find that capacity build-up has been costlier and near term SatCom momentum has been slower than we expected, weighing heavy on EBIT in Q4’22. Interestingly, Saab indicates an extremely bullish long term outlook for NLAW while the past year’s revaluation of Saab has yet to translate to the KebNi share. Now financed throughout 2023, we find support for a hike of our fair value to SEK 1.9-2.9 (1.7-2.8) per share in 12-24m.

Johan Widmark | 2023-02-27 08:00

Increased costs and slower than expected SatCom in Q4’22

While Q4 did not deliver the pick-up in revenues that we had expected, primarily in the SatCom-segment, the activity and forthcoming ramp-up in Inertial Sensing continues to gain traction. Revenues amounted to SEK 5.4m in Q4’22 resulting in full year revenues of SEK 26m, compared to our forecast of SEK 38m. Costs increased towards the end of the year, mainly due to the establishment of the production lines in Karlskoga ahead of the large-scale Inertial Sensing production. EBIT was further hampered by write-downs of SEK 15m and another SEK 2.5m which was previously balanced in ongoing projects.

Additional Saab order and indications of further upside

As for NLAW, the backdrop for KebNi’s IMU continues to improve, with Finland placing a SEK 400m order to Saab the other week, in addition to the SEK 2.9bn from the UK and SEK 900m from Sweden already in the order book. Interestingly, actual deliveries of the NLAWs to Finland in 2024, in addition to the order from Sweden and the UK, support a scenario where KebNi could exceed its SEK 150-200m revenue target range in 2024. But we see it as more likely with delays compared to the timeline communicated by Saab, but have hiked our forecast for 2024 to SEK 180m.

Also interesting to note is the recent Saab Q4 report conference call where CEO Micael Johansson stated that the ramp-up in NLAW production capacity is huge and that Saab will double production capacity 3x to 2025.

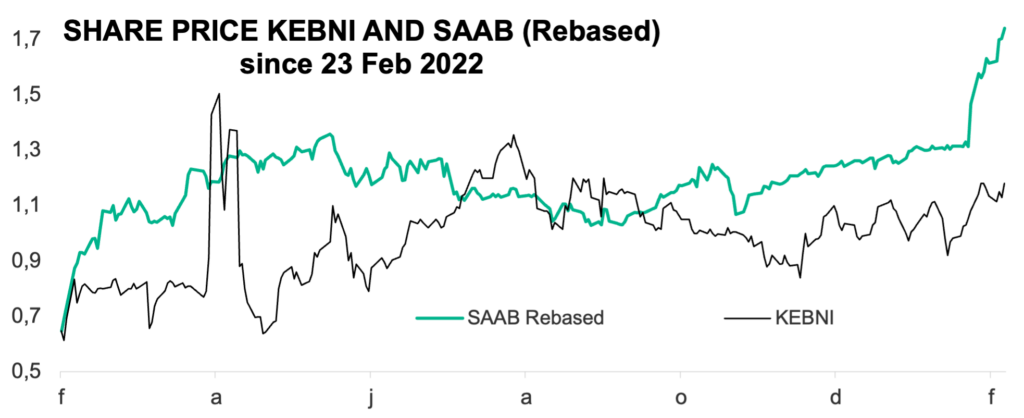

On the anniversary of the invasion of Ukraine, that triggered this renewed demand in NLAW, it is interesting to note that Saab (a diversified military equipment company) is up some +170% since before the war, while KebNi that already has received Saab-orders 2x its annual revenues before the invasion, is only up 75% since.

Maintain forecast of 7x revenue growth to 2025

While IMUs to Saab is a significant piece of KebNi’s new strategic roadmap, there are also other pieces that will leverage the company’s advanced technological platform within stabilisation, positioning and satellite communication to reach the targeted revenue of 150 – 200 MSEK already in 2024 and 20-25% annual growth in the following years, positive cashflow and an EBITDA-margin of 5-10% in 2024.

We now view follow-on orders from Saab and new Satcom orders as primary catalysts in the medium term, and find support for a fair value of SEK 1.9-2.9 (1.7-2.8) per share in 12-24m.

DISCLAIMER