Johan Widmark | 2022-11-24 08:40

Saab alone not enough to drive 7x revenue growth to 2025

KebNi’s new strategic plan centres around leveraging the company’s advanced technological platform within stabilisation, positioning and satellite communication. In the plan KebNi targets a revenue of 150 – 200 MSEK already in 2024, 20-25% annual growth in the following years, positive cashflow and an EBITDA-margin of 5-10% in 2024.

With the first firm series volume production order from Saab of 76 MSEK received in October, which the company will start delivering on in 2023, the plan reflects a high conviction about receiving follow-on orders from Saab to start executing on in the spring of 2024. But with the ramp-up with Saab reaching some 170 MSEK in annual revenues in a couple of years, Saab alone is not enough to drive the near 7x revenue growth we forecast to 2025 (compared to trailing 12 moths). Instead, KebNi now plans for steep growth across the board.

Current cash position sufficient to avoid another raise

We find a couple of elements in the plan of particular interest. First, the ambition to drive revenue growth with a high degree of customer financed development, as the company has already done with Saab. This will enable the company to scale and continue investing in product development without raising new equity. Second, the ambition to reignite activity within Satcom Maritime, where we see ample growth opportunities to the east, with both IAI and an increased presence in Southeast Asia. For both Satcom Land and Maritime, Kebni is targeting the non-geostationary satellite market and also moves into the low profile antenna market expanding in the Coms-On-The-Move segment.

The ambition to make acquisitions mentioned in the strategic plan makes most sense if adding geographic reach, customer relationships or technology that bolts on well to existing portfolio. As for safety solutions for the scaffolding market, where we see significant long term potential, this will play a negligible role in driving growth to 2024.

Wide valuation range implied in new targets

Guided by the strategic plan we have raised our mid-term forecast to now expect sales in 2024 of 170 (113) MSEK, which is near the midpoint of the company’s own target. As for costs and profitability, it will be a stretch to grow at high double digit rates for years while maintaining a high gross margin and low OPEX growth. We would therefore need to see more of the company’s plan materialize before discounting the company’s target of an EBITDA of 5-10%.

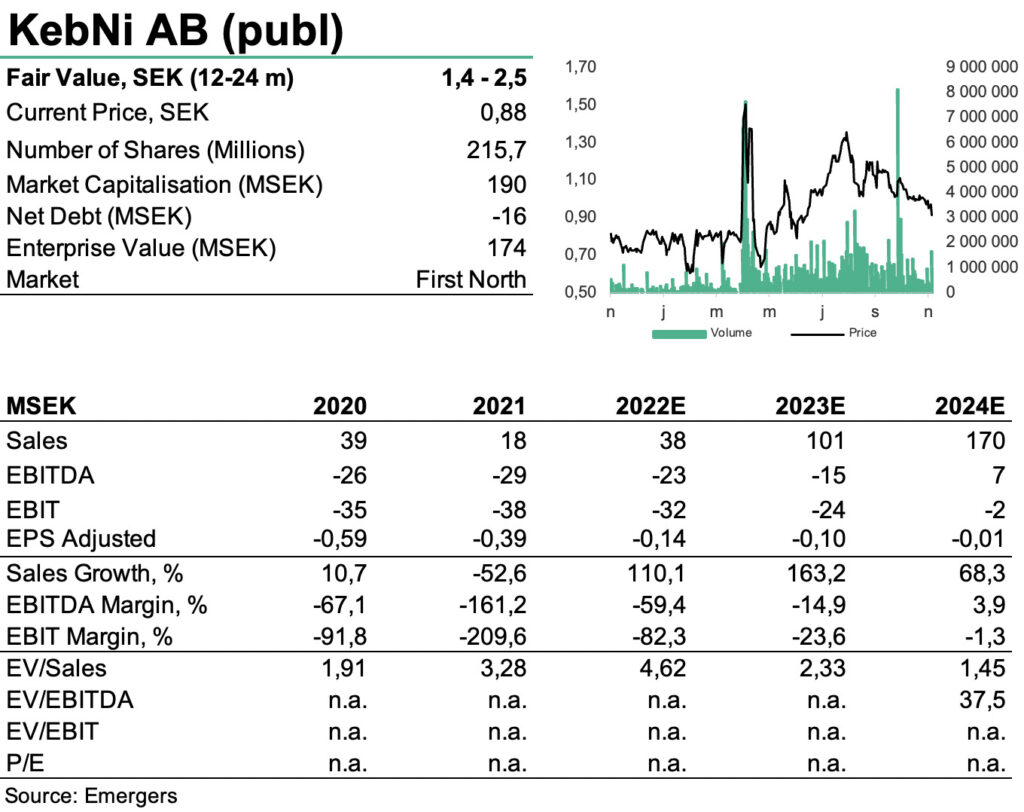

Looking at implications, a future development in line with the high end of KebNi’s growth targets and a long term EBITDA-margin of 25% by 2027 and 30% beyond, would imply a DCF-value (WACC 20%) of SEK 3.0 per share. The low end of KebNi’s target and a 20% EBITDA in 2027 and 25% beyond, would on the other hand motivate a DCF-value of SEK 1.4. All in all, our own revised forecast and a combined peer multiple and DCF-approach now provide support for a fair value of SEK 1.4-2.5 (1.4-2.1) per share in 12-24m. We now view a follow-on orders from Saab and new Satcom orders as primary catalysts in the medium term.

DISCLAIMER