Johan Widmark | 2021-08-25 10:15

Strong momentum in build-up behind the lull this quarter

The report for the second quarter reflects a high level of internal activity at KebNi, demonstrating excellent potential to re-style the company into a more sales-oriented organization with a broader and more current product offering, including everything from the new 1.8 meter drive-away antenna, an IMU offering that highlights the forefront of technology with the launch of NG IMU, and a sales organization with a tripled reach in terms of partner presence by 2022. At the same time, short-term growth continued to weaken in the second quarter, with basically non-existent sales, earnings of SEK -10 million and operating cash flow of SEK -17 million.

Mixed performance in the existing portfolio

In addition to the final delivery to IAI during Q2 2021 and scheduled deliveries of IMU prototypes to SAAB, Satmission is now preparing a road show during the autumn that should be able to make an impact on sales in the medium term. At the same time, development work is underway on the company’s own IMU application for monitoring scaffolding, which is expected to be launched in 2022. Although we expect small volumes initially, our calculations show (see our most recent update Scaffolding focus in new vertical with great potential) annual revenue potential of SEK 100 million, and the application will be able to expand to real-time monitoring of a variety of other areas with little or no modification.

Read our report on KebNi here

KebNi investing in payback from 2022

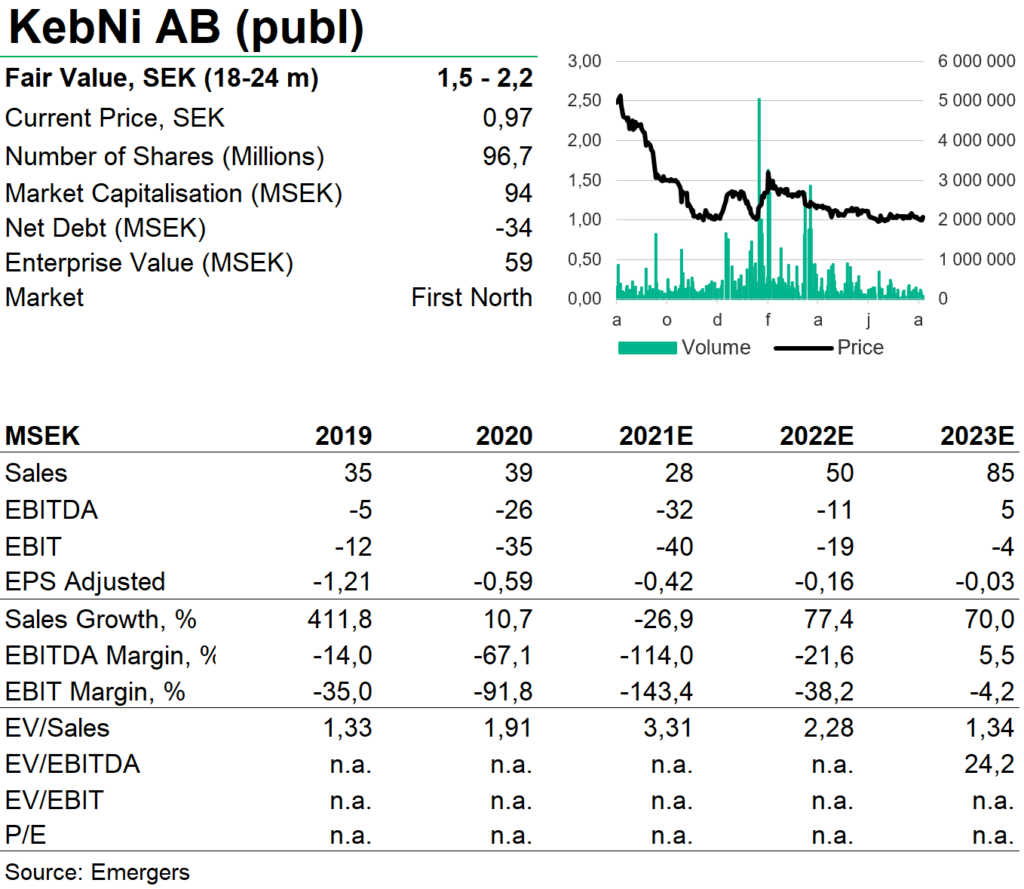

KEBNI With a strong bet on inertial sensors (IMU) in addition to the SAAB deal and increased sales efforts on satellite antennas, we see potential for a tripling of KebNi’s revenues in a few years’ time.

Expected strengthening of cash reserves towards winter

As the support from the underlying satellite operations has proven to be more variable and less predictable, we have lowered our expectations for sales this year and do not now expect numbers in the black until 2024. With operating cash flow so far this year of SEK -29 million and our lower level of expectation for the coming year, we anticipate a renewed need for capital during the winter. Adjusted for the dilution from an expected rights issue of SEK 20 million, our forecast provides support for a fair value based on DCF and comparative multiples of SEK 1.5-2.2 (2.5-2.9) per share on a horizon of 18-24 months.

DISCLAIMER