Johan Widmark | 2023-11-22 08:00

Double delays

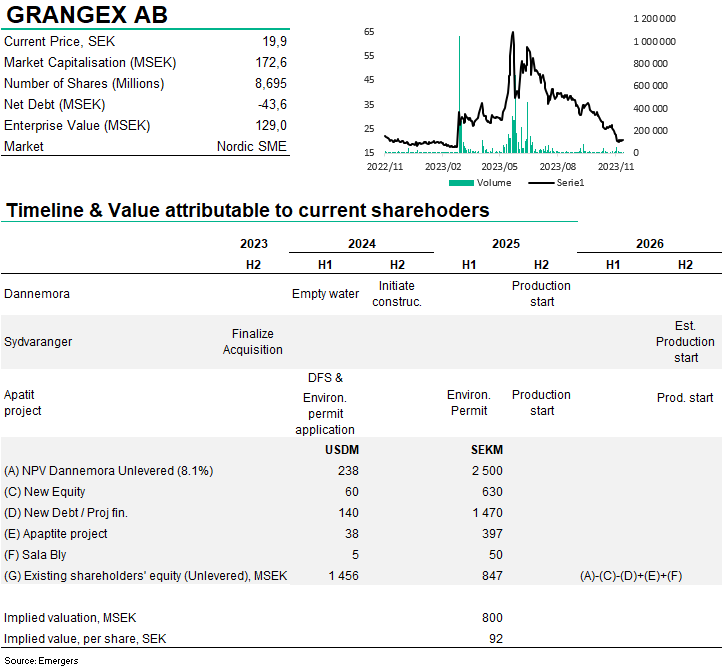

During Q3, GRANGEX has intensified the development of the Dannemora project, focusing on securing necessary drainage equipment and now expect to start drainage in Q1’23 (representing an approx. 6-month delay). The critical task now is completing project financing, as current working capital is insufficient for the planned activities over the next 12 months. Despite a weak macroeconomic climate, discussions with potential financiers are ongoing, and GRANGEX now expects to complete the major financing by Q2’24 at the earliest (also an approx. 6-month delay), with some short-term financial solution ahead of that. However, Anglo American’s involvement in financing and as a future product buyer, should provide significant support to this process.

Higher cost estimates

GRANGEX now expects to publish an updated DFS in Q1’23. In anticipation, we have modeled a 10% cost increase for both CAPEX and OPEX to reflect the past year’s inflation. Regarding the planned acquisition of Sydvaranger, the company does not anticipate publishing an updated DFS until later in 2024. However, we observe that the available study, with cost estimates updated in May 2023 and based on an iron ore price around half of today’s level, supports an NPV(8%) of USD 550m. Should GRANGEX succeed in upgrading production from blast furnace concentrate to meet the requirements for fossil-free DRI quality iron ore—a process step that incurs slightly higher costs but commands much better prices—the impact on NPV and returns could be substantial.

Considerable valuation potential with Sydvaranger on top

While we choose not to incorporate Sydvaranger into our valuation just yet, we estimate that Dannemora justifies a capital raise of approximately SEK 2.1bn through a combination of equity and debt. With the continued positive development in iron ore prices (with 65% grade iron ore currently at USD 145 per ton), we find support for an Unlevered NPV for Dannemora of SEK 2.5bn after tax. This translates to an equity value of around SEK 800m attributable to current shareholders, or SEK 92 per share. Should all proceed as planned, the Sydvaranger acquisition will significantly increase the capital requirements and could substantially enhance our valuation calculations.

DISCLAIMER