On its mission to provide the same level of robustness to digital payments services as is required by other commercial and public goods that are critical for our modern society, Crunchfish are now expanding their scope beyond digital payments to all types of digital applications with their patent pending, protocol agnostic Trusted Application Protocol (TAP). Combined with the intended acquisition of an Indian payments platform company Crunchfish are expanding in several dimensions – market potential, people, presence, product and patent portfolio simultaneously.

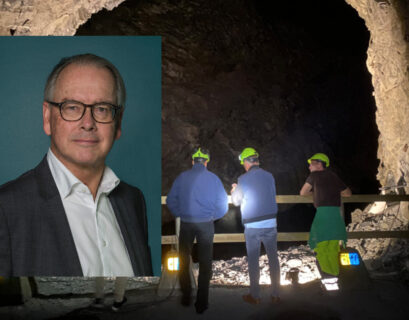

Here CEO Joachim Samuelsson elaborates on the recent two news from the company and provide an update on the progress in India.

Andreas Eriksson & Johan Widmark | 2023-03-01 11:00

Malmö-based deep tech company Crunchfish offer payment systems with the similar robust design philosophy as the internet delivers for digital communications. The aim is to provide digital payments with survivability in the face of any temporary failures, just as the internet protocols do for digital communications.

– Compared to other utilities and goods, like electricity, telecom or the internet, all digital payments systems lacks robustness, which should not be acceptable given their critical roles in society. This is due to the current “circuit-switched nature” of digital payments systems. If the payer cannot get internet access or any of the many backend servers are down, then it is not possible to pay. With our patent-pending protocol we’re driving a paradigm shift in payments, says Joachim Samuelsson, CEO Crunchfish.

In terms of business, Crunchfish have made the most progress in India, with an ongoing offline payments pilot with HDFC Bank and one other Indian bank, monitored by the Reserve Bank of India (RBI). This is now live with external customers and merchants, using real money, as evidenced by the HDFC Bank website ”OfflinePay – Payments that work, without any network”. With over 60 million customers at HFDC Bank alone, a potential firm deal at scale offers significant potential.

Expanding beyond digital payments to all digital applications

With the recent announcement of the patent application for the Trusted Application Protocol, Crunchfish are now expanding its market potential beyond payments. TAP may be applied to any type of digital applications to make it robust and offer a secure client with a trusted identity.

Applied for instance to the leading digital authorization and signage application in Sweden, BankID, this would mean that users of BankID could use the application without access to the internet.

– We have applied for a patent for a protocol agnostic generalization to all types of digital applications, not just digital payments. We offer the same trusted client as we offer for Digital Cash payments to any type of digital application. Take BankID for example. To use BankID today you have to have online internet access. If BankID were to integrate Crunchfish’s trusted client in the frontend apps, you could also connect to the BankID’s backend service via SS7 signaling used in telecommunications or provide digital authorization completely offline peer-to-peer over a local network or using proximity-based communication like BLE, NFC, Ultrasound or even QR.

This expansion has significant implications for Crunchfish’s addressable market.

– In addition to an electronic identification service like BankID it is also useful to in client server applications that execute a single command at a remote server. Automatic login without a passphrase to a remote server is also possible as the client is secure and trusted. This expands our addressable market significantly from payments to many more digital applications in other fields. We plan to offer it with the same subscription-based business model as we have for offline payments, but for a considerably larger market, says Joachim Samuelsson.

Simultaneous expansion in several other dimensions

With the announcement of the acquisition of an Indian payments company, Crunchfish are also expanding in several other dimensions.

– The Indian payments platform company that we may acquire have a full-stack solution that essentially offers Digital Cash online services. With the acquisition Crunchfish can now deliver also the backend part of the Digital Cash solution, i.e. a full-stack client server offering to central banks, banks and payment services.

The acquisition will expand Crunchfish’s presence in Mumbai, India’s financial centre and the capital of the world when it comes to real-time payments. The banks in Mumbai probably process more real-time transactions than what all other banks outside of Mumbai process combined.

– The targeted payments company also has an Indian patent that protects how to reserve money in the bank by a lien, by a pre-authorization similar to how card companies reserve money from the traveler’s bank account at check-in at ahotel to pay for the stay as well as any other expenditures at the hotel. This may be useful with Digital Cash as an interest-bearing way to reserve money at the bank for offline transactions.

Crunchfish group CEO Joachim Samuelsson is in Mumbai during the whole week together with Patrik Lindeberg, CEO of Crunchfish’s subsidiary Crunchfish Digital Cash AB, and Rutger Lindeberg, R&D Director of Crunchfish Digital Cash AB. The due diligence process will start immediately in parallel with a very busy meeting schedule organized by Vijay Raghunathan, Head of Crunchfish India and Gagan Kochar, Head of Business Development at Crunchfish India who have come down from Delhi for the week.

– There are lots of exciting stuff going on. And I think one of the key focal point from an investor perspective is the progress in India, where the feedback on the pilot from the Reserve Bank of India has been “Scale it up” to more users, says Joachim Samuelsson.

READ EMERGERS’ EQUITY RESEARCH ON CRUNCHFISH HERE

CRUNCHFISH: The most interesting fintech rollout since iZettle

Andreas Eriksson & Johan Widmark | 2023-01-24 11:30

DISCLAIMER