Johan Widmark | 2024-08-19 11:00

This commissioned research report is for informational purposes only and is to be considered marketing communication. This research report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and Emergers is not subject to any prohibition on dealing ahead of the dissemination of investment research. This research does not constitute investment advice and is not a solicitation to buy shares. For more information, please refer to disclaimer.

Capital-light expansion going forward

Sales in Q2 reached SEK 7.1m with an EBITDA of -8.5m, similar to Q1. The Härnösand facility’s utilization improved to 72%, up from 59% in Q1, though lower than the 95% in Q2’23. Cash at the end of Q2 was SEK 0.9m, but Agtira has secured a SEK 20m loan from major shareholders, ensuring runway until the Haninge facility starts in mid-Q4’24.

Over the past two years, Agtira’s self-funded investments in Skellefteå, Birsta, and larger greenhouses in Östersund and Haninge have strained liquidity. The Kramfors NP3 deal, where Agtira will instead be a tenant and operator, and the Newsec partnership now offer a more capital-light expansion model, reducing future capital needs.

SEK 120m ARR pushed forward

The production start in Haninge in Q4’24 will increase the annual production rate from around SEK 50m to over SEK 60m. Additionally, Agtira signed a 10-year agreement with Lidl Sweden in Q1’24, totaling SEK 400m over 10 years. To secure supply for this deal, Agtira will establish a 2,000 m² facility in Kramfors, with construction starting this quarter, with another 6,000 m² next year. Combined with other projects, Greenfood in Boden, and the Coop Nord system in Umeå, this could double ARR to SEK 120m in a few years, though we remain cautious about capacity and timeline, which is why the sales ramp-up in our updated forecast has been pushed slightly forward.

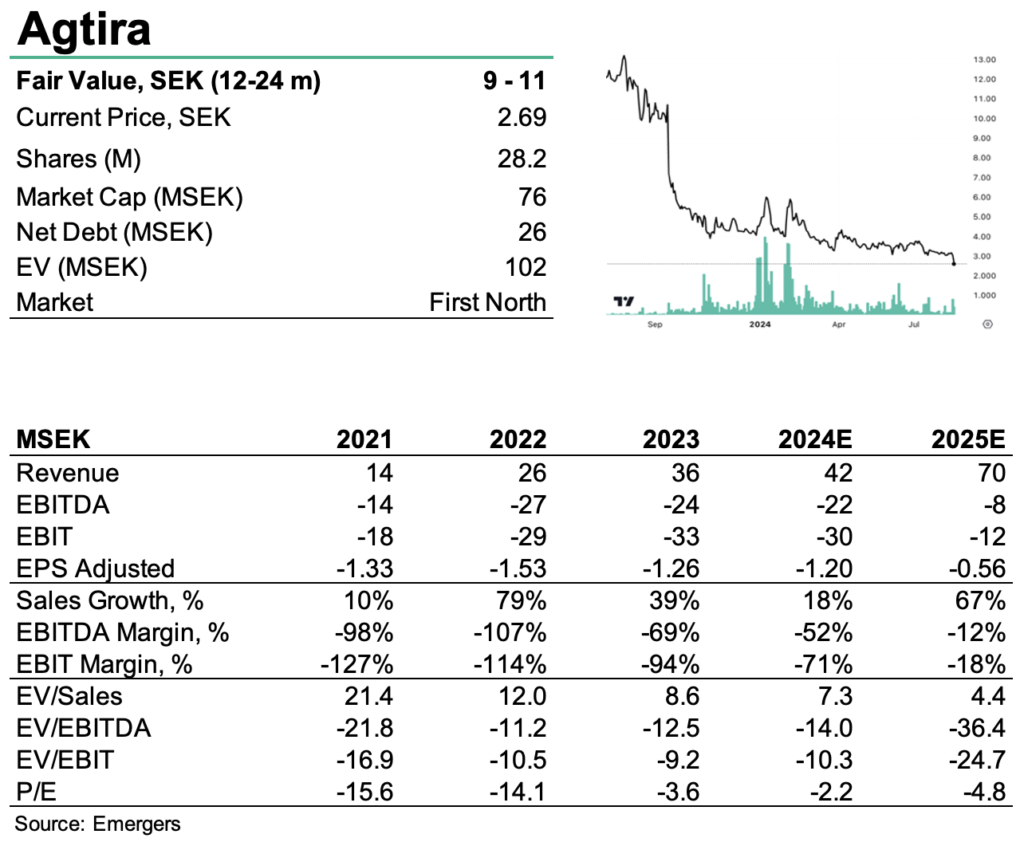

Support for a Fair Value of SEK 9-11

Agtira’s finances have been under pressure for some time, now alleviated by a SEK 20m shareholder loan. However, this is likely to become an issue again before achieving profitability. Overall, we expect the coming years to be very exciting for Agtira. Using a combination of target multiples and DCF (WACC 15%), we now find support for a fair value range of SEK 9-11 (10-13) per share, adjusted for a SEK 30m raise in 2025.

DISCLAIMER