Johan Widmark | 2024-11-29 10:30

This commissioned research report is for informational purposes only and is to be considered marketing communication. This research report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and Emergers is not subject to any prohibition on dealing ahead of the dissemination of investment research. This research does not constitute investment advice and is not a solicitation to buy shares. For more information, please refer to disclaimer.

The first clinical demonstration of a once-monthly GLP-1

The Phase I study of NEX-22, a once-monthly depot formulation of liraglutide (a GLP-1 analog) conducted in collaboration with Profil, a leading diabetes CRO, met all primary and secondary endpoints, demonstrating dose linearity, a one-month pharmacokinetic profile, and no significant adverse events, including the absence of nausea or vomiting. Minimal or no local reactions were observed. This is especially encouraging considering that the dose administered was 17x the normal daily dose. Liraglutide, developed by Novo Nordisk, is currently marketed as Victoza and Saxenda, both requiring daily injections, unlike NEX-22’s once-monthly.

The trial involved three dose-escalation cohorts of type 2 diabetes patients, with the first dose administered in June 2024 and the study concluding in November 2024. Subcutaneous administration proved effective, and the results indicate significant potential for increasing patient adherence and reducing treatment discontinuation, common issues with existing daily GLP-1 products like Victoza and Saxenda. The results mark the first clinical demonstration of a once-monthly GLP-1 product for diabetes patients. With these results, Nanexa plans to actively seek licensing partners for NEX-22 and advance to Phase Ib/II studies next year. These studies aim to directly compare NEX-22 to Victoza and explore a 505(b)(2) regulatory pathway in the US.

NEX-22 an attractive proposal for new entrants into GLP-1

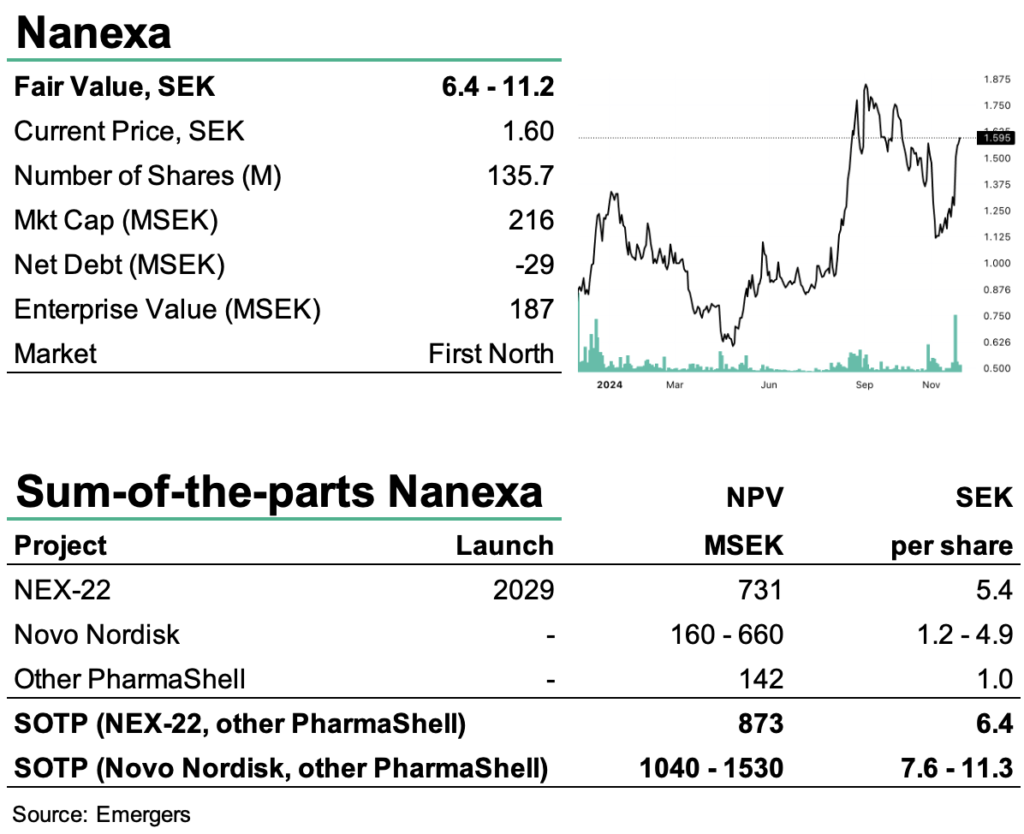

With the positive Phase I results, we now expect smoot sailing towards initiating Phase Ib/II in Q3’25 and Pre-IND with FDA by the end of 2025. After Phase III with some 400 patients, an application for NEX-22 could realistically be submitted in 2028 and with a product on the market by 2029, some three years ahead of any competing long-acting Semaglutide drug. This should be a highly attractive proposal for a potential licensee of NEX-22. Furthermore, it is worth keeping in mind that the 505b-path to approval (for new or modified versions of previously approved drugs) can roughly be compared to Phase III for a New Chemical Entity.

DISCLAIMER