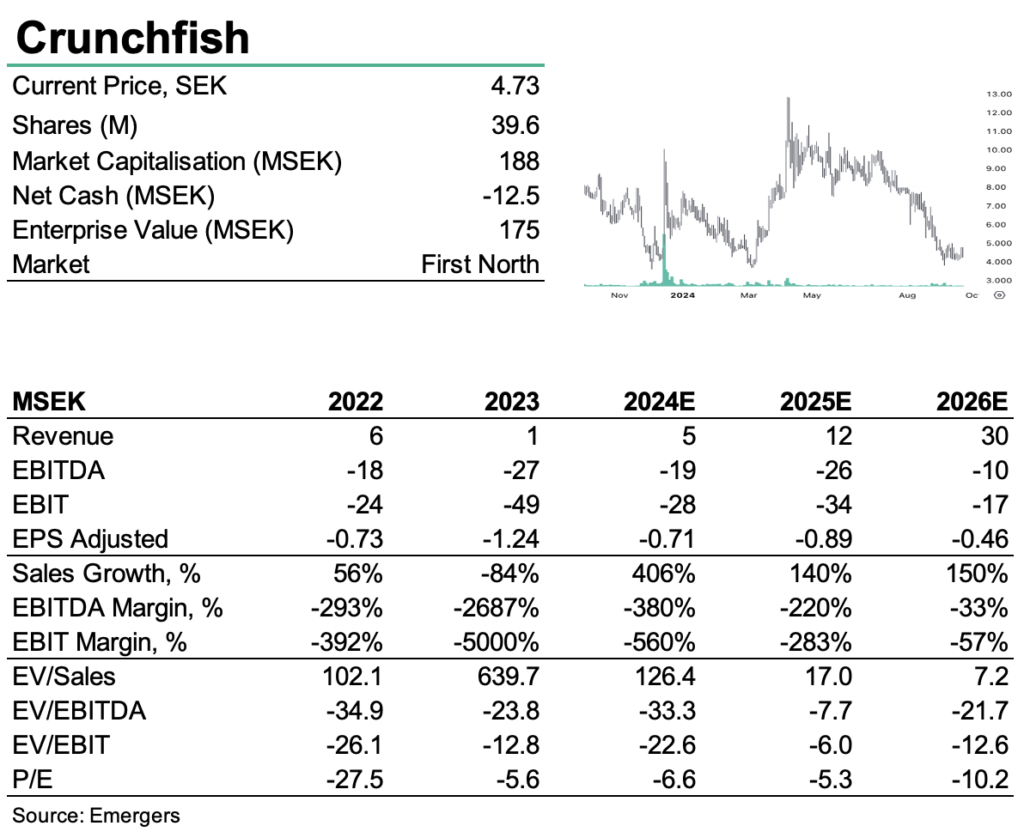

As discussed in our previous update, Crunchfish has now settled on a path forward for the company’s financing. On Friday after the market closed, the company announced its resolution to carry out a preferential issue of shares and warrants (Units) amounting to SEK 57 million before issue costs, covered up to 45% (SEK 26 million) by subscription and guarantee commitments. At full subscription, this would yield net proceeds of SEK 45.6 million or SEK 42.5 million should the guarantors opt for cash compensation. This will cover operating expenses for another 12 months, during which time Crunchfish also has two warrants (TO 10 and TO 11) that could potentially raise an additional SEK 36 million and SEK 48 million, respectively, in February and May 2025.

While the commercialization of Crunchfish’s solution for offline payments has shown a longer sales cycle than expected, the company continues to build a broader base of potential counterparties and business arrangements. We continue to see particular (albeit binary) potential in the new partnership with the world’s largest IT consulting firm, TCS, and the ongoing trial and proposal process with an undisclosed major payment provider. While this continues to support a high revaluation potential (previous fair value was 3x the price prior to the announcement of the rights issue), we now await the outcome of the rights issue before setting a new target, as it is customary for the share price to gravitate towards the subscription price (at SEK 1.45 per share) before it can regain momentum after having secured new fuel.

Johan Widmark | 2024-09-23 08:00

SEK 57m if fully subscribed

The rights issue consists of a maximum of 19,823,453 Units, where each Unit includes two newly issued shares, one warrant series TO 10, and one warrant series TO 11. The subscription price is SEK 2.90 per Unit, equivalent to SEK 1.45 per share. If fully subscribed, the Rights Issue will raise approximately SEK 57 million before costs, then issuing 39.6m new shares, meaning a 50 dilution for non-participants. This will cover the company’s operating expenses for 12 months. Additional proceeds could be raised in February and May 2025 if the warrants are exercised at up to SEK 1.88 and 2.17 respectively.

The rights issue is crucial for Crunchfish as the company seeks to continue its market development, particularly in India, where it is pioneering offline payment solutions. The funds raised will be primarily allocated to marketing, sales, and product development, supporting ongoing projects and potential expansions in other regions like Southeast Asia, Africa, and Latin America. Crunchfish’s partnership with TCS and dialogues with the National Payments Corporation of India are part of a broader strategy to establish its Digital Cash solution, although the process has taken longer than anticipated.

The most promising avenues towards revenue

Among all of Crunchfish’s current activities, two avenues hold particular promise. One is the alliance agreement with Tata Consultancy Services (TCS), the world’s largest IT consultancy company, targeting CBDC projects where Crunchfish will augment TCS’s Quartz solution for CBDCs with offline payments capabilities. Although there are no formal commitments on either side, the partnership with TCS—an IT consultancy giant with offices in 55 countries—significantly expands Crunchfish’s reach and presence, enabling a greater potential scale of relevant customer interactions.

Secondly, the security and vulnerability assessment for a major payment platform provider announced in late May has now progressed to a request for a Proof-of-Concept for trusted crypto operations in their mobile clients as well as a proposal for usage of Crunchfish’s solution throughout all their payment products. As the company continues to expand its potential base of potential customers, we see a fair chance for a an agreement in the coming year. However, any resulting revenues will accrue gradually. With confirmed dialogues with MasterCard, Google and many others, we look forward to seeing the first signs of traction soon.

DISCLAIMER