In the first half of December, KebNi’s single most important customer, defence company Saab has received two orders for its handheld antitank weapon NLAW, for 2.9 BN SEK and 900m MSEK, from the UK and Sweden respectively.

Being the supplier of IMUs for these units, this is great news for KebNi. We now expect to see follow-on orders on the 76 MSEK Saab order in October, soon. Most likely KebNi can look forward to delivering >4000 IMU units per year in 2023-2026 corresponding to around 130 MSEK in annual revenues from Saab alone.

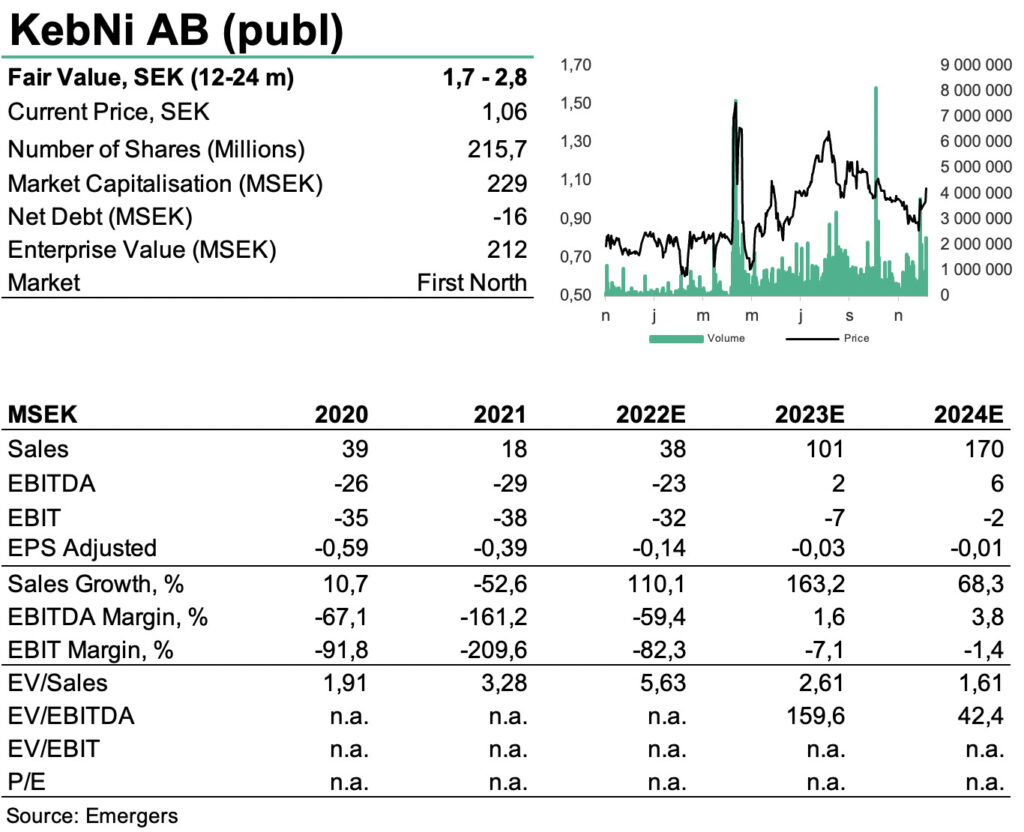

While this is largely in line with our expectations, not least after KebNi’s recent strategy update in late November, it effectively lowers the risk in KebNi, which translates into a reduced discount rate (from 20% to 16%) in our DCF. This motivates a hike in our fair value to 1.7-2.8 (1.4-2.5) SEK per share in 12-24m.

Johan Widmark | 2022-12-19 10:30

Saab order intake likely to equal >4,000 IMU units per year

While Saab has only disclosed the order value, it is fair to assume that the 2.9 BN SEK order from the UK is to replace all the 10,000 NLAWs that the UK has sent to Ukraine. This would equal an NLAW unit price of SEK 290 kSEK. With an estimate of 30,000 SEK per IMU to each unit this would mean 300 MSEK in revenues for KebNi, in line with our previous estimates. Applying the same unit estimates for the 900 MSEK order from Sweden, with deliveries from Saab to the UK in 2023-2026 and to Sweden in 2024-2026, this totals some >4,000 units per year at full production, and annual revenues of >130 MSEK.

So far, KebNi has received an initial order for series production of 76 MSEK from Saab. But in light or Saab’s own order intake we expect follow-on orders to KebNi soon, in order to secure production, which is particularly an issue given the current lead times in global supply chains for this type of hardware.

Maintain forecast of 7x revenue growth to 2025

While IMUs to Saab in a significant piece of KebNi’s new strategic roadmap, there are also other pieces that will leverage the company’s advanced technological platform within stabilisation, positioning and satellite communication to reach the targeted revenue of 150 – 200 MSEK already in 2024 and 20-25% annual growth in the following years, positive cashflow and an EBITDA-margin of 5-10% in 2024. For more on our view on the strategic plan, see our report KEBNI: New targets reflect high conviction in strong growth across the board in 2023-2027.

While the news from Saab does not motivate a revision of our forecast, it lends further support to our sales forecast of 170 MSEK in 2024, which is near the midpoint of the company’s own target. That means lower risk for investors in KebNi, which translates into a reduced discount rate (from 20% to 16%) that in turn motivates a hike in our fair value to 1.7-2.8 (1.4-2.5) SEK per share in 12-24m. We now view follow-on orders from Saab and new Satcom orders as primary catalysts in the medium term, where the former should now quickly be drawing closer.

DISCLAIMER