GRÄNGESBERG EXPLORATION With the Definitive Feasibility Study (DFS) for Dannemora and the appointment of financial advisors to implement a two-phased funding structure, GRANGEX now enters the next, construction phase in Dannemora. With a strong case to produce high-grade (+68%) iron ore concentrate with low carbon footprint, Dannemora meets the profile demanded by producers of green steel.

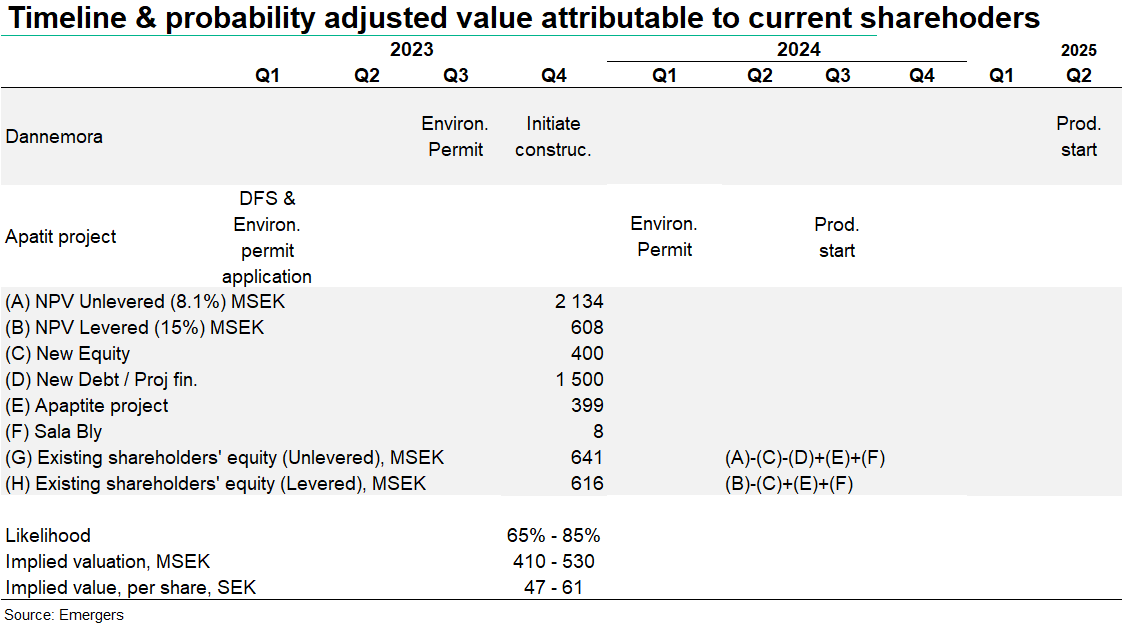

While the inflationary environment has a meaningful impact on projected costs, this is offset by longer production period (11y) and a 17% strengthening of the USD/SEK, compared to the PFS. Combined with a recent 24% increase in mineral reserves for the Apatite project, a 700 MSEK hike in required financing and a revised financing structure, we find support for a risk-adjusted fair value of 47-61 (98-168) SEK per share in 12-24m.

Johan Widmark | 2023-01-16 12:00

Strong case for CO2 free iron ore, albeit at higher cost

In the announcement of the DFS, GRANGX shows that a world class product can be feasibly produced with a minimal carbon footprint at Dannemora for a longer period compared to what was presented in the Pre-Feasibility Study (PFS). The DFS is also based on recent quotations and price lists and thereby captures the high inflation in 2022 resulting in 700 MSEK higher initial CAPEX (1.2 BN SEK to 1.9 BN SEK) as well as 22% higher maintenance CAPEX and OPEX, although this is offset by the 17% stronger USD/SEK-rate.

All in all, this gives Dannemora an Unlevered Net Present Value Pre-tax of 2.9 BN SEK in the company’s model (in line with the NPV in the PFS) which is based on 8% discount rate. With the appointment of financial advisors (Swedbank AB and SpareBank 1 Markets AS) the company now plans for a two phased capitalisation.

Mix of equity and debt

In our previous model we estimated 50% debt financing at 8% interest and 50% new equity with a return requirement at 15%, netting a WACC at 11.5%. Now we expect a smaller round of 400 MSEK in H1’23 to fund the planned CAPEX for 2023, and then a larger round around winter 2023/24 for the remaining 1.5 BN SEK. While these two rounds will probably involve a mix of co-investments from strategic investors, project financing with secured debt and equity, it is still difficult to forecast what the final structure will look like. But this will affect the Levered Equity Value for GRANGEX’s current shareholders.

Bullish outlook for Dannemora’s product

Considering that high-quality >67% Fe concentrate will be essential to facilitate the green transition, while only ~4% of global iron ore production is of >67% Fe grade, this will command a price premium compared to 62% and 65% Fe grade. And with the high-grade iron ore market segment expected to grow at an 8% CAGR, from 110Mt today to 750Mt in 2050, this premium is likely to expand in future.

Upwards reserve revision of the Apatite project

Earlier in December, GRANGX also announced an increase of the mineral reserves in the Apatite project, by 24% to 3.5 Mt after tests of the under-water part of the tailings in the JanMatts dam. This will likely extend the production period from 2028/29 into 2031. The apatite project in Grängesberg is a recycling project where the old tailings from the iron ore production at the closed Grängesberg mine will be recycled to produce highly enriched apatite. Next step for the Apatite project is the DFS and environmental permit application, which we now expect in Q1’23.

As for prices, the prolonged war in Ukraine and subsequent trade restrictions have resulted in an extension of the price peak in phosphate rock, with prices now parked north of 300 USD/t. For our valuation model however, we only include a small portion of this for the Apatite project.

Significant revaluation potential despite surge in costs

With a structural long-term growth in demand for green CO2 free iron ore and a prolonged supply crisis following Russia’s cut off from Europe we find both a strong fundamental case as well as a bright backdrop for the projects. We now expect production start for the Apatite project sometime early/mid 2024, Final Investment Decision for Dannemora around winter 2023/24 and production start in H1’25.

Guided by GRANGEX’ Company Presentation, we now expect a debt/equity raise in H1’23 totaling 400 MSEK, and another 1.5 BN SEK in winter 2023/24, of which we expect majority to be project financing/debt. Assuming 15% cost of Equity and 8% Cost of Debt this gives a discount rate of 8.1% after tax (roughly in line with company discount rate at 8%).

However, the higher upstart CAPEX for Dannemora increases our estimated upfront financing need from 1.3 BN SEK to 1.9 BN SEK. Along with a projected realised selling price (FOB) of 129 USD/t and OPEX at 55 USD/t we find support for an Unlevered NPV for Dannemora of 2.1 BN SEK after tax and a 27% IRR. Along with the Apatite project and Sala Bly, and reduced for project financing, this Unlevered approach gives a 641 MSEK in Equity Value attributable to current shareholders.

Applying a Levered DCF after tax approach, applying only the Cost of Equity (15%) as discount rate, this gives 616 MSEK attributable to current shareholders. Using the midpoint of these two numbers and risk adjusted with an estimated probability of successfully of 65-85%, this provides support for a fair value of around 410-530 MSEK or 47-61 (98-168) SEK per share in 12-24m.

DISCLAIMER